The Indian banking system consists of 12 public sector banks, 22 private sector banks, 46 foreign banks, 56 regional rural banks, 1485 urban cooperative banks and 96,000 rural cooperative banks.

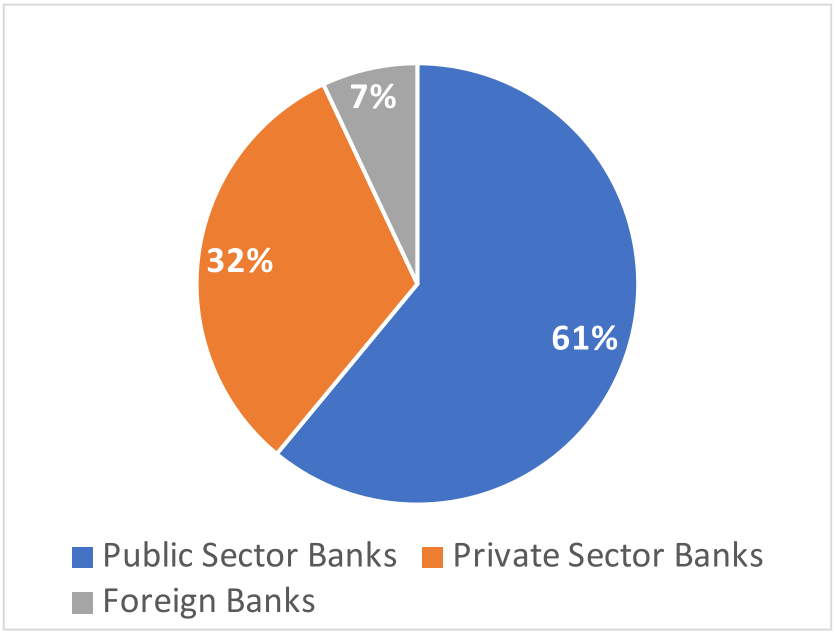

Though in recent years the governments have been giving full support to private banks, public sector banks still have the largest shares of assets.

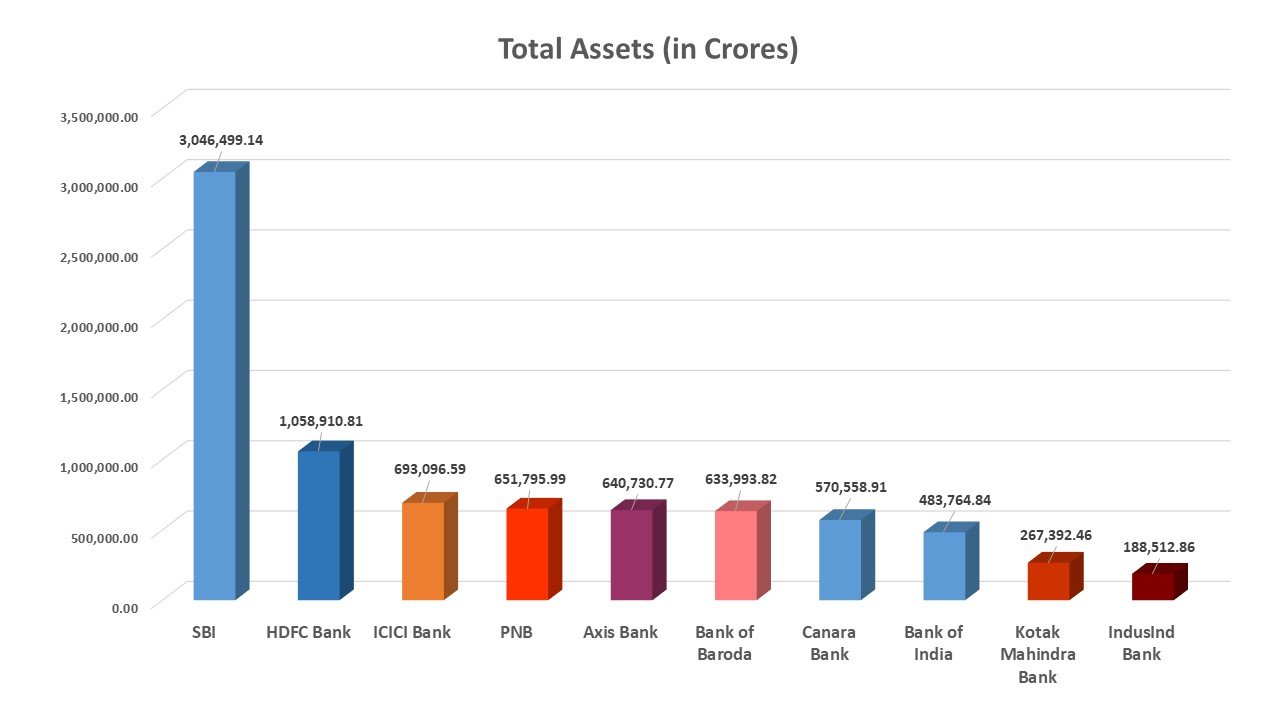

Bank Assets, FY 2020

The largest bank is the State Bank of India, which is a public sector bank. It is nearly three times larger than the next largest bank, the HDFC Bank, which is a private bank.

Banks remain the most trusted place to keep savings in India. The total deposits of all banks together as of April, 2021 were around Rs. 151 lakh crore. Banks are also the largest source of loans in the country; as of April, 2021, total loans given by banks were about Rs.108 lakh crore.

Banks prior to independence

Money lending for various purposes to people at large and even to kings was a very lucrative and profitable business. Individuals carrying out this activity used to be termed as sahookars.

All banks set up in India prior to the independence were private.

In 1720, the Bank of Bombay was established with headquarters in that city. Many banks were established after that. They were owned by English individuals or companies. The Allahabad Bank was the first Indian owned bank which was established in 1865 followed by the Punjab National bank in 1895 and the Bank of India in 1906. Many other Indian owned banks were established as an outcome of the Swadeshi movement.

It is important to note that 108 of those banks failed between 1913 and 1927, and more than 923 banks failed during the period 1928 to 1945. Individual imprudence, mismanagement, frauds, manipulation of accounts and reckless lending by owners besides incompetence and inexperience were the main reasons for these failures.

In 1935, the Reserve Bank of India (RBI) was set up to regulate banks, issue bank notes, and to keep cash reserves of banks.

Bank failures after independence and nationalization of banks

As of 1947, there were 82 scheduled banks and 555 non-scheduled banks, all privately held. In just 8 years from 1947 to 1955 as many as 361 banks failed, despite the RBI acting as the regulator.

In 1948, the RBI was nationalized. In 1955 the Imperial Bank was nationalized and named as the State Bank of India (SBI). 14 major private banks were nationalized in 1969 and 8 more were nationalized in 1980.

A number of new government owned banks were also established – IDBI in 1964, Regional Rural Banks (RRBs) in 1975, NABARD in 1982, Exim Bank and SIDBI in 1990.

Privatization of Banking Sector

Soon after the announcement of the New Economic Policy of Globalization through Liberalization and Privatization, a committee was formed in 1991 under the chairmanship of M. Narsimhan, the ex-governor of the RBI. Its major recommendation was to open banking for the private sector.

In the first phase, licenses for ten new private banks were issued in 1993 – ICICI Bank, HDFC Bank, UTI Bank (now AXIS BANK), Bank of Punjab, INDUSIND, Centurion Bank, IDBI Bank, TIMES, GLOBAL TRUST, DEVELOPMENT CREDIT BANK. Of these ten banks, only six exist today; four of them were merged with other banks due to financial problems they ran into.

In the second phase, licenses were issued in 2003-04 for two more private banks – Yes Bank and Kotak Mahindra Bank. Two more licenses were issued in the third phase in 2014-15 – for IDFC First Bank and Bandhan Bank. Thus, 14 licenses for private banks have been issued so far.

As per the suggestions of the Narsimhan Committee, the process of partial privatization of nationalized banks also began by the sale of a part of government shares in public sector banks (PSBs). As a result, the government shareholding in each of the PSBs has been reduced to various levels. The government shareholding in the largest public sector bank, SBI, is only 58% now.

From 2006 onwards many more committees were constituted by various Central governments. Each of them pushed for more privatization and also for reduction in the number of PSBs through their merger. As recently as 1st April 2020 10 public sector banks were amalgamated into four other public sector banks. As a result, the number of PSBs has been brought down from 22 to 12.

Every political party or coalition of parties in power at the Centre has pursued privatisation of the banking sector.

All these steps have been taken in spite of severe opposition by public sector bank employees and their unions and also by working people across our country.

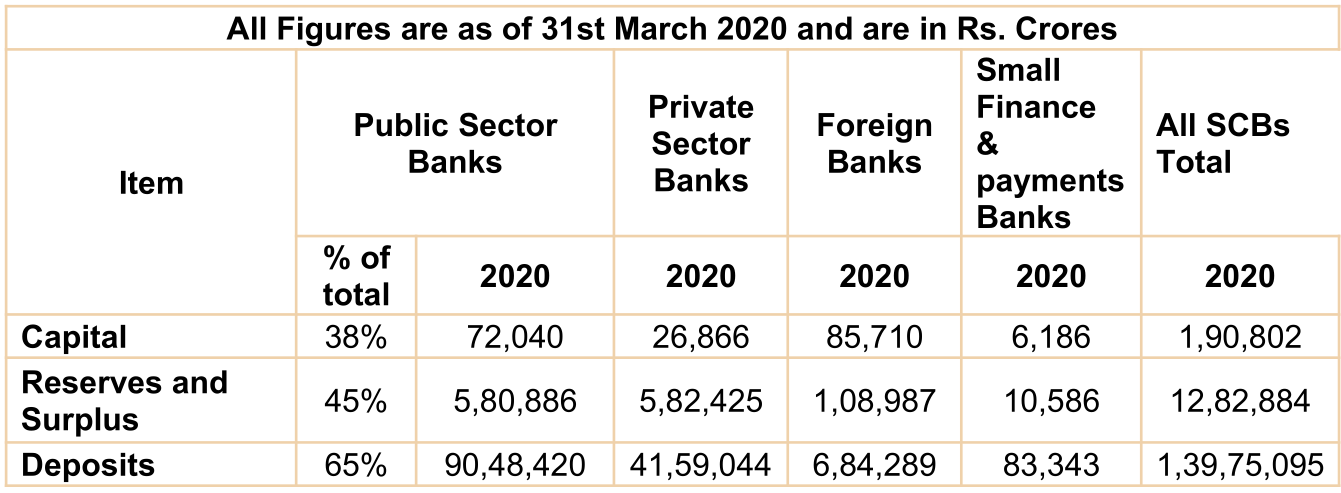

Despite all the push to privatisation, public sector banks enjoy the confidence of people. As of 31st March 2020, PSBs account for 65% deposits, 71% fixed assets and 51% other assets. This massive holding of deposits and assets of PSBs is what the big capitalists of our country and those of foreign countries are eyeing. That is why they are pushing the agenda of bank privatization.

Who is looting and who is being burdened?

Non-Performing Assets (NPAs) of public sector banks have been a matter of concern for the last decade. NPAs are loans given which are not repaid in time. Bank employees are blamed for these NPAs and the resultant losses of PSBs. However, the facts given below categorically prove that policies pursued by the RBI and the Central governments over the last 20 years are the real culprits.

One of the intended outcomes of all the “reforms” was to push banks to lend more and more money to borrowers even at the cost of diluting norms. The RBI and the government pushed the PSBs to aggressively lend to infrastructure, power, steel and textile projects by relaxing the norms. That enabled the corporates to borrow large amounts but without matching cash flows and the capacity to repay.

During the decade of 2004 to 2014 there was sudden expansion in bank credit from just Rs. 9 lac crores in 2004 to Rs. 52 lac crores in 2014, i.e. an increase of 477%! Various governments at the centre pursued the policy of taking advantage of the global economic boom prevailing at that time and achieve as much growth rate as possible. The RBI also claimed this as a big success story at that time. Many of these loans became bad debts or NPAs.

As a result, the gross NPA’s of the PSBs which were Rs. 47,300 crores jumped to as high as Rs. 6,78,318 crores! The provisions for bad loans and NPA’s in PSBs jumped from Rs.11,121 Cr in 2009 to Rs.2,29,852 Cr in 2019! From 2001 to 2019 the amount written off from profits by the PSBs towards bad loans was more than 6.79 lakh crores!

Due to the provisions for bad loans and contingencies all the PSBs put together started reporting losses, which were Rs.17,993 Cr in 2015-16 and increased to Rs. 26,015 Cr. in 2019-20!

All these losses and write offs are expected to increase further in the coming years. These losses are being financed from deposits of the working people of our country with the public sector banks!

The burden of private loot is thus being transferred on the backs of the working people of our country!

The All India Bank Employees Association has highlighted all the above issues to the RBI’s committee as recently as 30th May 2021.

Privatization of PSBs will further deepen the crisis

Not only before the nationalization of banks, but in the last 30 years too, many private sector banks collapsed and had to be closed. Yes Bank, Laxmi Vilas Bank, and PMC bank are the three big private sector banks which collapsed in just the last 3 years. The only aim of capitalists is to earn the highest possible profits, whether it is by borrowing from banks or by they running banks themselves. The crisis in the bank sector will further deepen with the privatisation of the PSBs.

Effect of bank mergers on workers

The merger of the 5 subsidiaries of the SBI with itself on 1 Apr 2017 resulted in the closure of 2500 branches and the loss of 10 thousand jobs within 6 months. The merger of 10 banks into 4 banks on 1 Apr 2020 is likely led to the closure of 7 thousand branches and the immediate loss of 4 to 5 thousand jobs.

Private sector banks are known to employ a huge number of workers on contract basis with extremely oppressive working condition and high level of job insecurity.

Privatization of Public sector banks will thus result in very insecure livelihood for workers.