Petroleum is a vital source of energy and fuel for road and air transport, for industrial furnaces and boilers as well as for power generation. It also provides raw materials for production of petrochemicals, plastics and fertilizers. The prices of petroleum products affect the entire population.

Petroleum is of strategic importance to the country. The army, navy and air force all depend heavily on refined petroleum products for their fuel requirements.

India is the third largest market for petroleum products in the world. Indian demand is growing four to five times faster than the global average. Total consumption of crude oil was about 212 million metric tonnes (MMT) in 2018-19. India’s annual oil refining capacity, at 249 MMT, is the fourth largest in the world, next only to the United States, China and Russia.

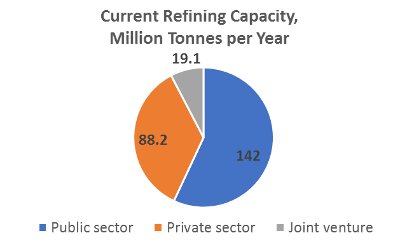

There are 16 refineries in the public sector. Two refineries have been set up as joint ventures – one between HPCL and LN Mittal group (owner of the world’s largest steel company) and the other between BPCL and Oman Oil Company. There are three refineries in the private sector – two owned by Mukesh Ambani’s Reliance Industries and another by the Russian company Roseneft (earlier owned by Essar of Ruias).

The country’s largest refining company is the government-owned Indian Oil, with annual refining capacity of over 80 MMT. Reliance’s annual refining capacity of 68 MMT from two refineries in Guajarat is the world’s largest refining capacity at a single location. More than half of Reliance’s capacity is dedicated for export. Roseneft owned refinery has annual capacity of 20 MMT.

Over 90 percent of the country’s fuel requirement is supplied by three public sector companies – namely, Indian Oil, BPCL and HPCL. The total annual capacity of these three companies has grown from less than 4 MMT in 1976 to 170 MMT at the present time. Their total assets are worth more than Rs. 5.5 lakh crore. The privatisation of BPCL and HPCL will reduce the share of public sector refining capacity from 60% to around 42%.

Today, more than 75% of Indian fuel marketing business is owned by three public sector companies — IOC, BPCL and HPCL.

Petrol and Diesel are the most heavily taxed products by the central and state governments in the country. People are paying nearly Rs 6 lakh crore as taxes annually to central and state governments. Taxes account for nearly two-third of the price of petrol and diesel.

Privatisation of Refineries

The erstwhile British Company Burmah Shell, and the American Companies Esso and Caltex were nationalised between 1973 and 1976 to create BPCL and HPCL respectively.

The nationalisation of the foreign owned private companies had been carried out due to strategic defence considerations. Under Anglo-American pressure, the foreign oil companies had refused to supply fuel to the Indian Navy and Air Force during the Indo-Pakistan war in 1971.

Their nationalization was followed by the introduction of the Administered Price Mechanism to regulate and limit the prices of petrol, diesel and other petroleum fuels.

The process of liberalisation and privatisation petroleum sector began nearly two decades back.

• 1997: NELP (New Exploration Licensing Policy) allowed Indian and foreign corporates to search for oil land an in sea.

• 1998-99: Sale of shares of public sector oil companies began. Today the government’s share of the equity has come down to only around 53% in BPCL, 55% in IOC, 63% in ONGC, and 68 % in Oil India.

• 2002: Complete deregulation of petroleum products; abolition the Oil Coordination Committee, which used to administer price control. Licenses for retail distribution of petrol and diesel were issued to private refineries.

• 2003: Attempt to privatise BPCL and HPCL failed due to powerful united opposition of workers and legal problems.

• 2016: Under the guise of repealing out-dated laws, the Central Government annulled the Nationalisation Act of 1976.

• 2018: Government sold its entire shares in HPCL to ONGC as a first step towards its privatisation.

• 2019: Decision for sale of BPCL to a private company.

About BPCL

It is the third largest in terms of oil refining capacity and second largest in terms of fuel market share (25% of the market). It has three refineries at Mumbai, Kochi, Bina after the sale of Numaligarh refinery to Oil India Ltd in March 2021.

• BPCL has over 15,000 petrol pumps and 6000 LPG distributors.

• It has 77 major installations and depots for storing and distribution of petroleum products.

• It has 55 LPG bottling plants.

• It has 2241 km multi product pipelines.

• It has 56 Aviation Fuelling stations in Airports.

• It has 4 lubricant plants.

• It has facilities for loading/ unloading crude and finished products in major ports.

• It has 11 subsidiary companies in India and abroad and 22 Joint Venture companies.

• It has 6,000 acres of land across India, of which 750 acres is in Mumbai alone, valued in thousands of crores.

• It employs over 12,000 regular workers, and 20,000 contract workers.

BPCL has been in the fortune 500 list for the past 16 years. Last year BPCL has contributed Rs 94,000 crore as tax to Central and State governments. BPCL is a very profitable sector petroleum refining company with net profit after tax of around Rs. 19,000 crore on 2020-21.

It has been estimated that the total value of BPCL is Rs 7 – 9 lakh crores. The Central government is planning to sell this precious public asset for less than 10% of its value.