Ports have a great strategic importance for external trade of the country. They handle around 95% of India’s external trade by volume and 70% by value. External trade is an important contributor the country’s economy with exports contributing about 20 percent to India’s GDP.

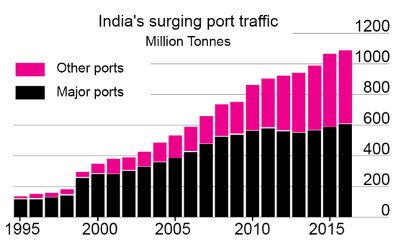

There are 12 “Major Ports” and around 200 “Minor Ports” along the 7500 km long coast line of our country. The total cargo handled by all ports together was 1320 million tonnes (MT) in 2019-20. The 12 “Major” ports are all owned by the Central Government. Out of the over 200 “Minor” ports, only 62 handle cargo, and most of them are privately owned.

The division of ports between “Major” and “Minor” is misleading as some of the so called “Minor” ports are much bigger than many ports termed “Major”.

Gujarat has the largest number of private ports as well as the country’s largest private ports of Mundra and Pipavav. It accounted for as much as 70 percent of total cargo routed through minor (private) ports in 2017-2018.

The major and minor ports together have annual capacity of 150 crore tonnes, of which only 120 crore tonnes is currently utilized.

Adani Ports is the country’s largest port operator with annual capacity of over 40 crore tonnes, more than 25% of the country’s total capacity and Adani owned Mundra port is the country’s largest port now.

Every year the major ports under the control of the government are earning an average of Rs. 5,000 crore as profit yet they are being privatised.

The number of regular workers at the government-controlled ports has been brought down from 1,13,000 in 1993 to only 24,000 now. The government has refused to fill in1 lakh vacancies in the major ports.

The revenue of major ports in 2019-20 was around Rs 16,000 crore.

Major ports have more than 2.7 lakh acres of land some which is very valuable, being in cities like Mumbai Kolkata, Chennai, etc. and is a big attraction for corporates.

Privatisation of Ports

Private ports are already handling nearly half of cargo and their share will keep increasing due to the government’s policies to promote them. Moreover, private ports are free to fix their rates which they keep low rates initially to lure cargo, while the rates at major ports are fixed by the government.

The privatisation of ports began in 1997, under the Congress government when DP World, one of the biggest multinationals in this field was given contract to build and run Nhava Sheva International Container Terminal (NSICT) at JNPT (Jawaharlal Nehru Port Trust), Maharashtra.

In 2000, 100% Foreign Direct Investment (FDI) was allowed under the automatic route for ports and harbours. A 10-year tax holiday was given to Indian and foreign capitalists to develop, maintain and operate private ports, inland waterways and inland ports.

Both Indian and multinational port operators have been taking over Indian ports or developing new ports. Adani Ports has become a dominant player in this sector. It operates 10 strategically located ports on the Indian coastline and has acquired another two ports.

Mundra Port of Adani

Most of the container ports and berths are already under the control of multinationals. The three big international operators, APM Terminals, DP World, and PSA International dominate the container operation in the country. As more and more general cargo is now handled through containers, their domination is also growing.

Successive Central Governments have adopted a two pronged strategy for privatisation of ports. Firstly, they encourage the setting up of privately owned “Minor” ports in a number of ways. They support locations that would allow them to prosper at the cost of nearby “Major ports”. For instance, the privately owned Mundra, Dighi and Vizhinjam were promoted at the cost of government-owned Kandla, JNPT and Kochi ports respectively.

The other strategy is of handing over profitable berths at government owned ports to private operators. (Berths are places where the ships are parked at docks). Soon government owned ports will be left with only non-profitable berths. Government will use that to justify the selloff of the ports themselves. Out of the total of 240 berths at major ports, 69 (28%) are already run by private operators under the PPP (Public Private Partnership) model.

A further push to privatisation has been given through The Major Ports Authority Act, 2020. Ports owned by the Central government and run as ‘trusts’ will be converted into ‘authorities’. The ‘Port Authority’ will adopt landlord model — a model wherein the ownership will remain with the government while private firms carry out port operations. The landlord port, in return, gets a share of the revenue from the private firm. The Landlord Model for Ports is another way of privatisation. The investment for building a port, including acquisition of land, is done by the government. Once built, it is handed over to capitalists for making profit by operating the port.