Extracts from All India Bank Employees Association (AIBEA) Resolutions Book

The 29th National Conference of the AIBEA held at Mumbai from 13th to 15th May 2023 passed a number resolutions. (List of resolutions attached) The resolutions related to privatisation of banks are given below.

DEFEAT RETROGRADE BANKING REFORMS AND THE ATTEMPTS OF PRIVATISATION – DEFEND PUBLIC SECTOR BANKS

For the past few years, the banking sector especially the public sector banks have been target of the Government and in the name of “Banking Sector Reforms”, there are attempts not only to marginalize the Public Sector character of the banks but also there are overt attempts to privatise them.

Immediately after the 28th Conference of AIBEA held at Chennai during January, 2017, the Associate Banks have been merged with State Bank of India despite opposition not only from AIBEA but also from various political parties. Thereafter, the Government had decided that the merger of Banks would be decided by the “Alternative Mechanism”, consisting of Minister of Finance, Minister representing respective Administrative Department and the Minister of Road Transport and Highways. The Government of India has also exempted the merger of Public Sector Banks from seeking approval of Competition Commission of India. In this backdrop, on 17th September, 2018, the then Finance Minister announced amalgamation of Dena Bank, Vijaya Bank and Bank of Baroda. The merger of Dena Bank and Vijaya Bank with Bank of Baroda took effect from 1st April, 2019. On 30th August, 2019, the Mega merger of banks were announced and the mergers took effect from 1st April, 2020. Syndicate Bank merged with Canara Bank, Allahabad Bank merged with Indian Bank, Andhra Bank and the Corporation Bank were merged with Union Bank of India while United Bank of India and the Oriental Bank of Commerce were merged with Punjab National Bank.

The merger of associate banks with State Bank of India and the other mergers of Public Sector Banks did not give any gain as highlighted by the Government. On the contrary, there have been reduction in bank branches. A total of 13660 branches have been closed down between 31st March, 2020, to 31st March, 2022. While the total number of bank branches as on 31st March, 2020, were at 98306 and it got reduced to 84,646, as on 31st March, 2022. To that extent, the density of bank branches and the ratio of per branch to population it could serve has gone up in a retrograde manner.

All through the history, the banking sector in any country is the financial backbone of development and especially in a developing economy like India, the banks play a crucial role in augmenting the resources for the development. The savings of the common man and the general public deposited with the bank shall have to be utilized for the purpose of developmental activities so that there will be a progress in economy with harmony and equity.

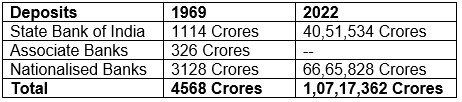

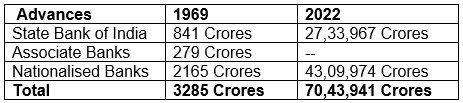

A comparison between the contribution of Public Sector Banks from the time of nationalisation till now would highlight the following achievements.

There have been impressive developments of the public sector banks and it has created Green Revolution, White Revolution, Blue Revolution and the spread and the reach of Public Sector Banks developed all sectors of the economy. Agriculture, rural development, employment generation, small and medium industries, infrastructure development, best health, education, poverty alleviation, empowerment of women etc., have been given due thrust after nationalisation of banks and these areas still require priority and attention even though there has been a phenomenal development in the last 54 years.

However, in the name of banking sector reforms, the public sector banking is sought to be marginalized. To add insult to injury, on 1st February, 2021, the Honourable Minister for Finance had announced that apart from IDBI Bank, two Public Sector Banks would be privatized. There have also been other retrograde moves by the Government in the name of Banking Sector reforms viz., allowing FDI in private banks up-to 74%, increase in voting rights in private banks to 26% and 10% in public sector banks, ineffective efforts made to recover NPAs, trying to bury the bad loans under the carpet through selling to ARCs and NARCL, technical write-off, allowing more private sector banks, encouragement shown to foreign banks to open branches, etc.

The Conference feels that the ills afflicting the banking industry cannot be addressed with these recommendations and it will only aggravate the problems further. Banks deal with public money and people’s hard-earned savings. More than 70% of the huge deposits of the banking industry come from the domestic savings. The retrograde moves of the government will work to the detriment of the national interest and injurious to the public sector banks and also would decelerate the economy.

Indian public sector banks have a primary social obligation and responsibility to take care of the needs of the various segments of the economy. In every decision of the government, public sector banks have been in the forefront. Opening of Jan Dhan and no frill accounts etc., the public sector banks have played a pivotal role and accolades have been showered on the employees and officers of the public sector banks by all concerned. Even in sanction of Mudra Loans, Public Sector Banks have their share with more than 90% of the loans sanctioned by them. Hence, the need of the hour is the expansion of the Public Sector Banking and nationalization of all private banks. The public sector banks need to be strengthened.

Therefore, this 29th Conference of All India Bank Employees’ Association that is being held from 13th to 15th May, 2023, at Mumbai, is of the firm view that the situation warrants continued campaign and struggle against the various ill-advised policies of the government relating to banking industry.

The Conference decides to build up broader united approach on the issues concerning the banking industry for sustained and united struggles and also should strive to enlist the support of the political parties, central trade unions, mass organisations and the people at large, to these patriotic struggles in the overall interest of the national and national economic development.

What is ailing the Banking Industry is the unrecovered Bad Loans from the Corporates and Big Industrialists. Instead of recovering the Bad loans from the business tycoons and Corporates, the government had resorted to amalgamation of Public Sector Banks. Even though due to the strike actions of AIBEA/UFBU, the Government could not bring the Privatisation Bill before the Parliament, the danger still looms large and the sword is hanging over the heads. During 2018, FRDI Bill was brought with the view to take away the money of the innocent depositors for the sins committed by the corporate defaulters. Due to public pressure and the fight launched by AIBEA and UFBU, the Bill has been withdrawn. But the attempt was clearly to pass on the burden of bad loans on the shoulders of the Depositors.

The Government has introduced Insolvency and Bankruptcy Code (IBC) and it was touted that it would bring about reduction in bad loans portfolio through recovery. However, it is a sad part of the commentary that till now the Government is advocating “resolution” of bad loans while what is required is “recovery”. This attitude of the government has resulted in the Corporate Defaulters escaping without recovery from them while the banks have to face the brunt and have to “write-off” majority portion of the loans. These write-offs have been euphemistically called “hair-cuts” In the end, the Banks are being made to bear huge haircuts and the IBC has become a way to loot.

In the given circumstances when Banks are passing through challenging times due to bad loans and huge provisions, recovery of bad loans is the only way out. The Government had proposed “Bad Bank”, National Assets Reconstruction Company Limited (NARCL), to transfer the bad loans from the banks and to whitewash their balance sheets. It is a naked attempt to camouflage the mess of bad loans contributed by the corporate borrowers. It is a cover-up operation. After the transfer of bad loans and when the balance sheets of the banks become healthy, there will be attempts to privatise the public sector banks. Already the announcement has been made by the Honourable Minister for Finance about privatizing two public sector banks. But, the danger would not be confined to two banks but to all the public sector banks.

Hence the 29th Conference decides that we must resist these attempts of privatization of public sector banks through struggles and strikes. Because for us in AIBEA, Public Sector Banks are Nation-Building institutions and they shall remain so. Public Sector Banking is an article of faith as far as AIBEA is concerned. The Conference welcomes the standing decision of UFBU to plunge into strike action should the government goes ahead with its privatization attempts.

The 29th Conference congratulates the rank-and-file membership for successfully observing the strike actions on 15th and 16th March, 2021 and again on 16th and 17th December, 2021, paralyzing the banking industry. The Conference also congratulates the AIBEA for having successfully observed 2-days’ strike action on 28th and 29th March, 2022, along with the Central Trade Unions, against Government’s anti-people economic policies including the attempts to privatise the public sector banks. The Conference exhorts the membership to await for further more calls in defence of public sector banking.

The Conference, therefore, decides that if the Government continues with their policies of privatization of public sector banking, intensive and extensive struggles including strike actions would become inevitable and necessary. Hence, we call upon the membership to prepare themselves accordingly.

The Conference also calls upon the members of AIBEA, Bank-wise Unions and State Federations to continue the Campaign against the privatization of Public Sector Banks, educate the rank-and-file membership, take the message to the customers of the bank and the general public through pamphlets and materials highlighting the achievements of the Public Sector Banks. Public Support should be enlisted to make our Campaign against Privatisation broad-based and our fight against privatization shall have to become People’s Movement.

This 29th Conference of All India Bank Employees’ Association being held at Mumbai from 13th to 15th May, 2023, decides to resolutely fight back these offensives by rallying round the banner of AIBEA and to implement all the Calls given by AIBEA and UFBU including strike actions against the ill-advised Banking Sector Reforms and against privatization of Public Sector Banks.

AGAINST PRIVATISATION AND SALE OF IDBI BANK

The Government brought the enactment in 2003 to convert IDBI into IDBI Bank and at that point of time, the Government has made a categorical assurance on the floor of the Parliament that at all times the Government shall maintain not less than 51% equity holding in the new setup of IDBI Bank. On the basis of this assurance, the Bill was approved by the Parliament.

Now, due to the huge pile of bad loans in IDBI Bank, the need has arisen to augment additional capital to IDBI Bank. LIC has invested to the tune of 49.24% in IDBI Bank and the combined holding of LIC and the Government of India is about 94.72%. After increasing the holding of LIC, the Reserve Bank of India has categorised IDBI Bank as a Private Sector Bank.

The erosion in capital in IDBI Bank is only due to huge increase in bad loans. If the accumulation of bad loans is due to change in economic scenario and such huge infrastructure loans are bad today, the Government must step in and provide additional capital. Because earlier IDBI was a Development Finance Institution, which provided credit in the form of long-term infrastructure loans.

On 1st February, 2021, in her Budget, the Honourable Minister for Finance announced that IDBI Bank would be privatised. Sometime ago, the Government has sought the Expression of Interest (EoI) and the applications are being processed now. But, as far as AIBEA is concerned, the Government should not reduce its stake to less than 51% which would amount to shirking its commitment to the Parliament and the nation.

IDBI Bank is a Commercial Bank and its problems like profitability, bad loans and inadequate capital, etc. need to be sorted out at the earliest and shirking Government’s commitment is no solution. Government should adhere to its commitment to retain minimum 51% stake in the Bank and must come forward with adequate capital contribution as was done in the past. IDBI Bank should not be sold to private hands.

This 29th Conference of AIBEA that is being held at Mumbai from 13th to 15th May, 2023, deplores the decision of the Government to sell IDBI Bank and decides to launch organisational actions including strikes against these moves.

Upload.Resolutions list-AIBEA conf.